Hey there analytics experts!

Need help parsing Flipside Crypto’s Aave data and solving our analytics bounties? No problem. Our Aave Data Cheat Codes are here to help you take your submissions to the next level.

Now, onto this week’s bounties. As always, feel free to reach out with any questions or comments on Discord.

Art Blocks 🎨

Bounty: min of $100 USDC

Undervalued Pieces

Ledger Status, the host of Up Only TV has been eyeing some projects in Art Blocks Playound, namely:

Rinascita by Stefano Contiero

Alien Clock by Shvembldr

Return by Aaron Penne

Sentience by pxlq

Eccentrics by Radix

Obicera by Alexis André

Ecumenopolis by Joshua Bagley

Choose a collection to dive into and try to identify anything in the metadata (take a look at features!) to make a case for why a specific piece may be undervalued.

Or compare these collections to each other and make a case for why one of the collections is undervalued.

Comparing Curated vs. Playground vs. Factory

Art Blocks offers 3 series: Curated vs. Playground vs. Factory

How do these series compare in terms of volume (transactions, price, and tokens)?

Playground Series

Once an artist completes a collection in Curated, they are given access to Playground. How many artists have taken this opportunity? How has their Playground collections' performance compared to their Curated collections' performance?

Aave Elite Bounties 👻

Bounty: Min of 0.63 AAVE

Aave vs. Compound Flash Loan Prevalence

Building on the previous bounty on Aave Flash Loan Prevalence, build out a similar analysis for Compound and compare the usage of Flash Loans on the respective protocols. Build a dashboard or tool to analyze flash loan use on Aave and Compound: how they are used (what protocols are the funds used with), how often, and how much (volume).

Loan Analysis Tool

Build a tool to see how APY earned/paid on a loan changed over a specific date range. Make it so that anyone can see the APY of any loan ever done.

Total Liquidity Dashboard

Visualize the daily total liquidity in Aave for the past year with the capability to zoom in/search for specific days or ranges of days. What are the most interesting ways to answer the question: What assets are dominant in Aave's liquidity pools and when?

Metric Dashboard

Create a dashboard that visualizes these metrics for any given week in the past year:

- Total Liquidity

- % Utilization (utilization of available liquidity) and generated interest for depositors

- Total flashloan volume in USD and amount of fees they generated for depositors

- Total USD liquidated and resultant fees for liquidators

- Total Fees generated for ecosystem income collectors on Ethereum (addresses 0x464c71f6c2f760dda6093dcb91c24c39e5d6e18c and 0xe3d9988f676457123c5fd01297605efdd0cba1ae - these addresses ingest the reserve factor and some of the flash loan fees, basically all of the protocol revenue)

- Total fees generated by the protocol

🦄 Uniswap

Bounty: Min of 1.96 UNI

Proposal Playbook

Getting a proposal passed playbook - check out past Uniswap proposals and the conversation/debate that went on with them. What are the main takeaways that you have for what made a proposal succeed? This question is clearly interesting to Flipside, but it would be independently dope to compile an encyclopedia of community-sourced advice on proposing things that anyone can use.

Uniswap TVL Projections

What is going to happen to Uniswap TVL in the coming quarter? Outline and model 2 strategies that you think could be used to project Uniswap TVL. Treat this as an exercise in discovery rather than accuracy.

Terra 🌎

Bounty: Min of 1.41 LUNA

Average Trade Sizes

What are the average trade sizes across the top 5 assets by volume traded with native Terra swaps currently?

Hint: Use the terra.swaps table to find all native swaps

Stablecoin Total Supply

Make a visualization that shows the total circulating supply of each pegged currency in the Terra ecosystem over the past 6 months. Hint: Use the terra.balances table.

Choose your topic!

This is an open-ended research topic (500 word minimum) and it can be about anything related to the Terra ecosystem; as always, it must use data and provide visualizations to support the piece.

TerraSwap Pool Fee Performance

What are the top 5 TerraSwap Liquidity Pools by fee APR over the past 6 months?

Minimum Liquidity for Slippage Prevention

What is the minimum amount of liquidity in a pool needed to prevent significant slippage (>5%) on TerraSwap? Is this related to the average trade size of a given pool?

Anchor bAssets Usage

What is the number of users who are using Anchor to both borrow against their bAssets and place those borrows directly in Earn? What is the average leverage LTV risk they are taking in doing this?

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

In this week’s edition, we’re giving our Terra bounties some more love in the form of a dashboard from @lostindefi.

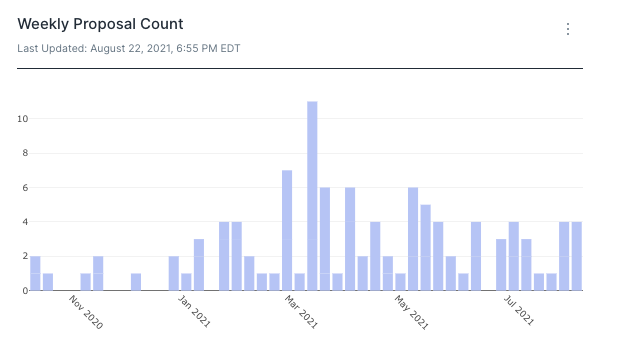

This submission looked to zoom further into the proposal and break them down by when they’re proposed and what type of proposal they are.

As we can see in the graph above, there was a notable increase in proposal activity around the release and debut of Anchor Protocol on March 17. There was a similar increase in proposals following the LUNA price crash on the week of May 17.

@lostindefi also examined governance proposals based on who’s proposing them and more. Check out the whole submission here.

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: