Mirror, mirror, on the wall…

We’ve got a new scavenger hunt for you all in the form of our new Magic Mirror Hunt. Check it out here, and get started on your exploration of the Mirror ecosystem.

Now, onto this week’s bounties. As always, feel free to reach out with any questions or comments on Discord.

↪️ Curve + 🪙 Yearn

Bounty: up to 1,666.66 USDC

yveCRV Vault 🏦

How has the introduction of the yvBOOST Vault impacted usage of the yveCRV Vault?

yveCRV Rewards 💰

yveCRV Vault users can claim rewards weekly, yvBOOST users have their rewards automatically claimed and reinvests into yveCRV to compound rewards. How many users are claiming rewards weekly in yveCRV? How much gas have yveCRV holders spent since yvBoost launched? Have users of the yveCRV vault made good decisions about claiming tokens with regard to gas fees?

Entering and Existing yvBOOST 🚪

Yearn's new Zap contract allows users to enter vaults from a variety of tokens and to exit vaults into a number of tokens. What tokens are people using to enter the yvBOOST Vault? What tokens are people using to exit the yvBOOST Vault?

Note: There are known duplicates in ethereum.udm_events that are being addressed. This should not create issues as determining the tokens used to Zap in or out of yvBOOST will require choosing the proper record from all logs and internal transactions captured in ethereum.udm_events

👻 Aave

Bounty: up to 2.97 AAVE

Fee Metrics Dashboard 💸

Building on the previous bounty on Aave Flash Loan Prevalence, build out a similar analysis for Compound and compare the usage of Flash Loans on the respective protocols. Build a dashboard or tool to analyze flash loan use on Aave and Compound: how they are used (what protocols are the funds used with), how often, and how much (volume).

Safety Module Dashboard 🦺

Build a tool to see how APY earned/paid on a loan changed over a specific date range. Make it so that anyone can see the APY of any loan ever done.

Design Your Dream Loan Explorer 🧭

Visualize the daily total liquidity in Aave for the past year with the capability to zoom in/search for specific days or ranges of days. What are the most interesting ways to answer the question: What assets are dominant in Aave's liquidity pools and when?

🦄 Uniswap

Bounty: Up to 185.87 UNI

Build Your Own Mega Dashboard 📈

Combine prior grand-prize-winning submissions into a single, interactive dashboard that can give users a broad view into the Uniswap ecosystem. Flash and flair win the day here — we want to see not just your best data analysis, but a functioning front-end, plus a competent and insightful narrative to help readers understand the data.

🌎 Terra

Create your own Lido Scavenger Hunt 💧

Bounty: Up to $100 in LDO

Description: Build your own Lido Scavenger Hunt to help bring new users into the ecosystem! Start by teaching new users to stake ETH on LIDO, then help them follow the steps to use bETH on Anchor. Feel free to include extra activities or steps on top of these to help integrate users further into the ecosystem.

🟪 Polygon Bounties

Bounty: Up to 3,472.22 MATIC

Build Your Own Mega Dashboard 🟣

Combine prior grand-prize-winning submissions into a single, interactive dashboard that can give users a broad view into the Polygon ecosystem. Flash and flair win the day here — we want to see not just your best data analysis, but a functioning front-end, plus a competent and insightful narrative to help readers understand the data.

🦡 Badger Finance

Bounty: Up to 353.68 BADGER

Create Visualization Of Badger Boost Data 📊

Description: Build a visualisation/animation of the badger boost data that allows us to see the changes in the native/non native balances of users over time. There could also be some analysis of the stake ratios and multipliers of each user. Thi

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

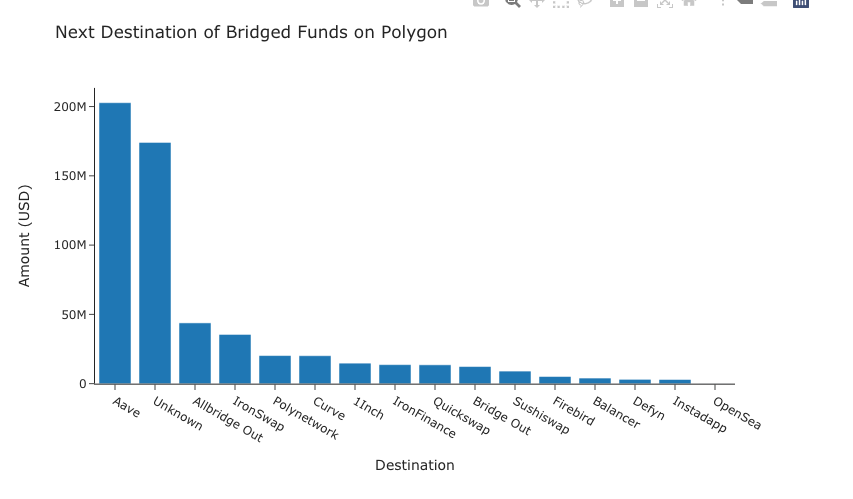

In this week’s edition, we’re giving our Polygon bounties some more love.

Where do most people head once they decide to embrace those low fees? According to this submission from @ScottInCrypto, Aave leads the way for new entrants — by a long shot.

Interestingly, 11% of funds bridged into Polygon are bridged in immediately bridged out in the next transaction. @ScottInCrypto points out that “it’s possible that Polygon is being used as an intermediate step to bridge to other ecosystems.”

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: