Time to get wet 💧💸💧

New bounties just launched on Flipside Crypto for Lido, the liquid staking protocol.

Check them out below along with the rest of this week’s bounties. As always, feel free to reach out with any questions or comments on Discord.

💧 Lido

Daily bETH Volume 🔥

Bounty: up to 80.99 LDO

What is the daily volume of bETH bridged from Ethereum to Terra using Lido? Has there been an increase leading up to Columbus-5? What is the daily volume of bETH bridged from Terra back to Ethereum? (We have data from bridging through Lido, but not from eth to terra via the https://bridge.terra.money/)

stETH Usage 🥩

Bounty: up to 80.99 LDO

What are users doing with stETH from Lido? (Possible use cases to explore: https://blog.lido.fi/steth-defi-usecases/ )

Daily stETH Metrics 📅

Bounty: up to 80.99 LDO

Lido’s staked ETH (stETH) metrics questions: Daily volume of stETH? Average stake size? Number of stakers over time? Average time staked? Percentage of stETH converted to bETH and bridged to Terra?

Free Square Question 🤑

Bounty: up to 215.98 LDO

Provide any interesting insights on Lido. These will be judged by a council that includes other community members and the Flipside team!

🌎 Terra

Airdrop Query Repo 🪂

Bounty: Up to 5.73 LUNA

Description: Using the best airdrop-oriented submissions so far, curate a repository of boilerplate queries for finding the addresses that projects airdrop to.

Airdrop Price Impact 💰

Bounty: Up to 5.73 LUNA

Description: How do airdrops impact the price of a token? Find and analyze at least one example in the data.

Pylon/Apollo DAO Bounty 🏹

Bounty: Up to 11.48 LUNA

Description: Solve this: https://learnterra.io/gp-bounty-apollo/

Terra for Ethereans 🗺️

Bounty: Up to 11.48 LUNA

Description:

*Note that this bounty is restricted to Bounty Hunters and Gunslingers*

Map out the Terra ecosystem. Take the perspective of someone who knows Ethereum well and identify corollaries to pieces of the Ethereum ecosystem to help them understand.

Apollo Inflow ➡️

Bounty: Up to 11.48 LUNA

Description: Where have the deposits into Apollo originated from? ie. How much came from UST vs. existing LP positions? How much new liquidity was added from the bridges and exchanges?

APY Strats 🌾

Bounty: Up to 11.48 LUNA

Description: Develop a yield farming strategy that optimizes for APY using the Anchor and Anchor companion protocols. How does this APY compare to APY's that can be achieved on other platforms/protocols?

Liquidation Response 💦

Bounty: Up to 11.48 LUNA

Description: Choose 5 examples of borrowers on Terra who got liquidated - what happened in each of these cases after the liquidation occurred? Are borrowers likely to borrow again, or are they done? If they do borrow, do they borrow a more conservative amount relative to their collateral?

👻 Aave

Aave Launches + TVL 🚀

Bounty: up to .78 AAVE

What effect does a new token launch have on AAVE's total TVL? Can you identify "cannibalization" effects (transfer of liquidity to the new protocol) from existing lending/borrowing tokens when a new token is added?

Who is getting Aave rewards 🪙

Bounty: up to .78 AAVE

Do a breakdown of who is getting rewards from lending/borrowing markets as well as from the staked Aave (stkAAVE) Pool.

Hard Loan Dominance 💪

Bounty: up to 1.56 AAVE

What is the distribution of the ratio of Flash Loans used to Regular Loans used per user? Do borrowers tend to rely more on flash loans or traditional loans? (across all markets) Also, break this down on a volume basis - how much volume is borrowed using Flash Loans vs. Regular ones in total? Does this ratio change based on how much volume is being moved in individual trades (ie. what is the distribution of the Flash Loan to Regular loan use in borrows based on volume magnitude)? Finally, identify the top 10 users of Flash Loans by label and address.

🦄 Uniswap

Build Your Own Mega Dashboard 📈

Bounty: Up to 185.87 UNI

Combine prior grand-prize-winning submissions into a single, interactive dashboard that can give users a broad view into the Uniswap ecosystem. Flash and flair win the day here — we want to see not just your best data analysis, but a functioning front-end, plus a competent and insightful narrative to help readers understand the data.

🟪 Polygon Bounties

Build Your Own Mega Dashboard 🟣

Bounty: Up to 3,472.22 MATIC

Combine prior grand-prize-winning submissions into a single, interactive dashboard that can give users a broad view into the Polygon ecosystem. Flash and flair win the day here — we want to see not just your best data analysis, but a functioning front-end, plus a competent and insightful narrative to help readers understand the data.

🎼 Harmony

CentOS/RHEL/AL2: Support Installation For Harmony 🎵

Bounty: Up to 3426.29 ONE

Description: Package and distribute the Harmony binaries for Linux's CentOS/RHEL/AL2 distribution. For example, CentOS's yum install harmony-one should initiate installation of Harmony binaries alongside all the dependencies. Also allow the installation to be pinned to a certain version.

Ubuntu/Debian: Support Installation For Harmony 🎶

Bounty: Up to 3426.29 ONE

Description: Package and distribute the Harmony binaries for Linux's Ubuntu/Debian distribution. For example, Ubuntu/Debian's apt install harmony-one should initiate installation of Harmony binaries alongside all the dependencies. Also allow the installation to be pinned to a certain version.

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

In this week’s edition, we’re giving our Uniswap bounties some more love.

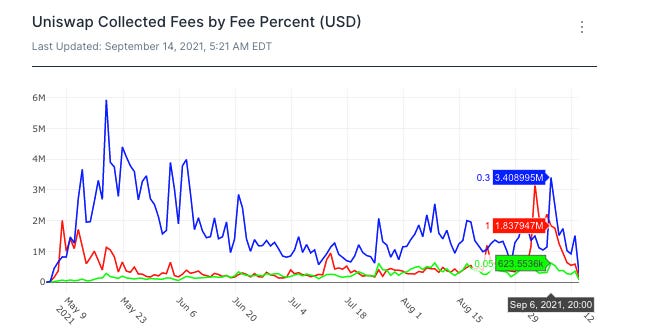

This week’s winner is a look at Uniswap fees from @darksoulsfanlol. This time, our analyst sought to find out which Uniswap pool is generating the most fees.

As we can see above, the .3% fee pools are collecting the most fees by far, particularly when compared to the .005% and the 1% tiers. The .005% tier fared the worst among the three, with just one pool among the all-time best fee-generators.

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: