Hello there, bounty hunters — welcome to week #30 of the Bounty Brief!

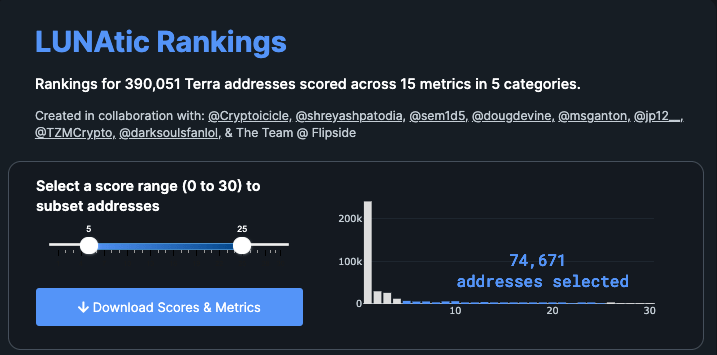

Calling all #LUNAtics: see how you stack up against other Terra degens with the new Terra ecosystem leaderboard from Flipside Crypto.

You can dive even deeper into the Terra-verse with our Pylon bounties below. We’ve also got a new set of Aave and THORChain bounty questions just waiting to be solved.

Check ‘em all out below.

👻 Aave

[Easy] Gas Prices and Deposit/Borrow Amounts

Bounty: up to .66 AAVE

As gas prices have continued to rise, how have average deposit and borrow amounts changed in response?

[Hard] Means of Repayment

Bounty: up to 1.34 AAVE

When people repay their loans, do they liquidate themselves and use collateral growth to do so, or are they paying off their loan with external (to Aave) funding? How does this relate to the collateral's price?

[Hard] Will I actually get liquidated tho?

Bounty: up to 1.34 AAVE

Because of high gas prices, positions that could be liquidated are sometimes not as the expense to do so would not cover the return for doing so. Is there a safe zone for where liquidation happens? How is this related to gas prices?

⚡ THORChain

[Easy] Wealth Distribution

Bounty: up to 14 RUNE

What is the distribution of wealth within the THORChain ecosystem? Show a histogram of the breakdown Hint: use transfers

[Easy] Whale Activity

Bounty: up to 14 RUNE

Among the wallets that own 10k+ RUNE, which pools are they currently LP-ing to?

Hint: use transfers and liquidity_actions

[Easy] Liquidity

Bounty: up to 14 RUNE

Of the wallets that have supplied liquidity in THORChain pools, what percentage have removed at least some of the liquidity? Hint: use liquidity_actions

[Hard] Pool Depth

Bounty: up to 28 RUNE

What is the current depth of each pool based on the number of LP-ers currently providing liquidity? Hint: use liquidity_actions

[Hard] Pool Stats 🔢

Bounty: up to 30.2 $RUNE

For each pool, show the following stats by day

Liquidity

Swap volume

Number of swaps

Total fees

Fees per $1000 swapped

Hint: use daily_pool_stats

[Hard] On-ramping 🛣️

Bounty: up to 30.2 $RUNE

What is the breakdown of new users on-ramping onto thorchain by chain? Show a breakdown of each wallet’s first thorchain transaction. Which chain are they coming from? Are they swapping for RUNE or for an asset on another chain?

Hint: use swaps + transfers

[Hard] Affiliate Fees 🪙

Bounty: up to 30.2 $RUNE

What Addresses are being used to collect affiliate fees? What are the incomes over time?

Hint: use swap_events

Read this (https://docs.thorchain.org/developers/transaction-memos#affiliate-fees) and this (https://medium.com/thorchain/affiliate-fees-on-thorchain-17cbc176a11b) to find out how to identify affiliate fees

💠 Pylon

[Hard] Free Square 🟩

Bounty: up to 2,567 MINE

Provide any interesting insights on Pylon. These will be judged by a council that includes other community members and the Flipside team!

[Hard] Visualize governance staking of $MINE over time

Bounty: up to 2,567 MINE

What are the trends? Compare $MINE staking trends with $LUNA staking, do you think a lockup period would be beneficial? For those that have stopped staking, what did they decide to do instead in the Terra ecosystem?

[Hard] LUNA Validators

Bounty: up to 2,567 MINE

For addresses that are staking MINE right now, what validators do they prefer for their LUNA staking? Are there any trends or commonalities?

[Hard] Swaps + Pools

Bounty: up to 2,567 MINE

How many tokens have been distributed via Pylon swaps? How many tokens have been earned via Pylon pools?

[Hard] Galactic Punks

Bounty: up to 2,567 MINE

How much UST has been deposited into the lottery since it’s inception? What has been the average UST deposit amount?

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

In this week’s edition, we’re taking a closer look at Terra data with @mintingfarms. Specifically, we’re examining

As @mintingfarms notes, bETH first made its appearance in mid-August of this year. Just a few weeks later, the newcomer saw its first real shakeup when ETH prices dropped from roughly “~3.9k to as low as ~3.0k” on September 7. So how did bLUNA react?

As we can see in the graph above, the oracle price of bETH remains consistently lower than the bETH oracle price. What’s more, as @mintingfarms points out, the Ethereum Uniswap v3 price as the height of the bar charts exceeded most bETH oracle prices (in green).

And when we examine the price ratio of bETH Oracle prices with the ETH price from Uniswap V3, as has been done above, we can see that the bETH oracle price was ~3.33% lower than the spot price of ETH on Uniswap v3 pool.

“Compared to bLUNA oracle price updates, it appears that bETH oracles update on a less frequent basis,” @mintingfarms notes. “This steepest decline was registered a 10.1% decline in bETH oracle price from the preceding reading. Ignoring this anomaly in absence of oracle updates, the next highest registered decline was at 1.77%.”

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: