Happy Friday, folks. We’ve got a special guest writer for today’s newsletter.

Flipside CFO Mike Featherstone reflects on his transition from TradFi to good ole web3.

We will continue to feature Flipside executives here, to get their takes on building strong web3 companies - in bear or bull markets.

Subscribe to get their insights, every Friday

Not long ago, I accepted a position as Chief Financial Officer of Flipside, a blockchain data company. My team and I could generally be thought of as “traditional” financial professionals who recently migrated from TradFi to the crypto industry.

You’d think that a topic as objective and boring as accounting wouldn’t change much between industries, but crypto is truly uncharted territory.

When I was debating whether to accept a job in crypto, I asked for advice from a friend who worked in the industry.

“You’ll never know what it’s like unless you take the job, and do it for at least a year. It changes so much week-to-week that you’ll never keep up from the outside.”

I guess you can’t expect anything other than frequent change in a new industry. But I’m a curious guy. I get bored quickly; I need something that’s always changing. That kind of environment excites me.

I later learned that what he really meant was you can barely keep up from the inside, which continues to be true with every new domino that falls thanks to the bankruptcy of FTX. I started my journey at Flipside Crypto at the frothy heights of the last cycle, and we’re now clearly in the middle of the coldest, hardest crypto winter yet.

One week it’s FTX, the next it’s 134 others.

Is crypto just naive?

Engagement cycles are draining. When the hype dies down, you find yourself facing fraud and financial collapse, like in much of 2022. And when the hype peaks, you’re listening to loud idealists hoping for revolution against the traditional economy. A popular (though by no means ubiquitous) narrative in those high-energy times is that crypto can usurp central bank control of currency, and decentralize the global economy. I’d be lying if the part of me that read Hayek and Von Mises back during my college economics days didn’t see something compelling there, even if the more practical me would say that was never gonna happen.

Some of my TradFi colleagues hear this and dismiss crypto as naive idealism. And it’s always, er, fun to get the latest meme making fun of Bitcoin from my siblings in our family Slack channel. And I’ll admit, being a recent outsider to the industry and a financial professional, the ideas of economic revolution don’t offer me much.

But becoming an insider has taught me a few things about technological progress, and I’m convinced that writing crypto off completely is a mistake too.

It’s easy to reduce crypto to naivety or fraud, especially when clickbait publications make the most of every opportunity. But while it’s easy to miss, the space has already created immense value, both financial and technological.

In this blog series, I’ll be breaking down what I’m learning in my time in crypto, and share what value I find in it with my TradFi colleagues, or anyone who’s curious about what hides beneath the headlines of this chronically inconstant industry.

Money isn’t everything

First, let’s clarify some definitions:

“Crypto” refers to cryptocurrencies, digital tokens which often aim to store value digitally. This has led to the creation of tools like stablecoins — fiat-pegged digital currencies that effectively negate the volatility of crypto (when they work, ahem, UST).

The phrase “crypto” places implied emphasis on this understanding that tokens are investable assets. It’s often true, but investability is just a sliver of what Web3 tech can offer (and one that invites regulatory scrutiny).

Tokens don’t have to be financial vehicles. They’re just symbols, and they can signify a theoretically limitless number of things. Non-fungible tokens (NFTs), for example, are already frequently iterated as pieces of artwork. Another token use case that interests us at Flipside are badges, tokens that signify roles or status in a community, grant feature access, or track accomplishments. (You can see this in action at trybadger.com.)

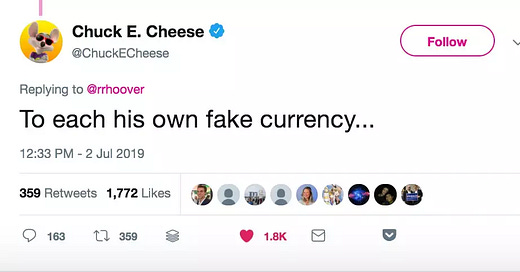

And even within quasi-financial use cases, the tokens-as-investments narrative can be detrimental. Digital tokens can gate platform usage, mimicking currency like tokens at an arcade. But if Wall Street started lining up at the nearest Chuck E. Cheese to add arcade tokens to their portfolio, it would spell disaster for the poor kid that just wants another shot at skeeball.

And yet, despite being just one of potentially infinite use cases, “crypto” is still largely understood as “crypto-assets”, and evaluated for investment potential. It’s a “miss-the-forest-to-set-the-trees-on-fire” scenario of spectacular scale, and, I’d argue, the reason the space is in so much turmoil.

As a result of this hyper-focus on assets and numba-go-up, malicious actors can exploit profit-expectant consumers pretty easily in this industry. All it takes is a bit of hype marketing, and, boom — investors are misled, people lose millions, and the media has a field day.

Mapping web3

But Web3, the sector that encompasses blockchain, cryptocurrencies, NFTs, and the platforms built around them, is full of unique development paradigms used by coders and social innovators alike to find new solutions to important challenges in the world - just, none so grandiose as economic revolution.

The technology has already helped unbanked people and residents of financially unstable countries. But helping the unbanked is not fighting entrenched banking, and at conferences with charismatic speakers on the subject, I often wonder, ‘Do you really want that fight?’

But If you can bring yourself to ignore that, erm, overenthusiastic niche, you might just find yourself nodding along as you read about decentralized governance, trustless systems, and digital currency, and how they might be able to help our work and our society move a few steps forward.

Our purpose at Flipside is mapping these new roads, and figuring out how and where people can travel along them. We take both a descriptive and prescriptive approach - gathering and analyzing usage data from the top blockchains and protocols, and by building DAOs, participating in decentralized governance, building primitive tooling that can be used by emergent communities, experimenting with NFTs and Web3 communities, and more.

My job as CFO is to make sure we have enough funds to continue that expedition as long as it’s helpful, and with capable professionals to make sure we don’t trip up any regulations along the way. As a result, I get to explore these new paradigms and technological advancements and how they fit into real global economies. As this industry grows and we continue to map it at Flipside, I’ll share what I learn in this blog.

See you for the next one!