Terra bounties have arrived.

You heard us.

We’re bringing community-enabled analytics to the Terra ecosystem, in the form of new bounties, available right now.

To get started or get your biggest Terra questions answered, join our community on Discord.

Now, onto the bounties.

Terra 🌎

[EASY] Transaction Fees 💸

Bounty: Up to 71.51 LUNA

Description: On Terra, transaction fees generated by token swaps work to maintain the peg of stablecoins to their associated fiat currency. How many fees are being paid out each day for the past 30 days? Do we see any big differences between the different stablecoins?

[EASY] Decentralization of Validator System ✅

Bounty: Up to 71.51 LUNA

Description: How decentralized is the validator system? Show the distribution of the staked amounts on the top nodes.

[EASY] Who Should You Delegate To? 👥

Bounty: Up to 71.51 LUNA

Description: How might someone decide which validator to delegate their Luna tokens to? Show the metrics that you think would be most relevant to that decision. Suggested data points: Commission rate; Total value staked

[EASY] Peg Variance 📈

Bounty: Up to 71.51 LUNA

Description: How stable are the stablecoins on Terra? Calculate how far from peg the stablecoins have performed in the past 6 months.

[HARD] New User Inflow 👤

Bounty: Up to 143.03 LUNA

Description: Show new user inflow to Terra. Relate this to new user inflow to Mirror and Anchor - for example, are the majority of Mirror and Anchor users new to the Terra ecosystem? Are the Whales on the Terra ecosystem engaging with Mirror and Anchor?

[HARD] Best Yield-Farming Opportunities for Terra assets on Ethereum 🚜

Bounty: Up to 143.03 LUNA

Description: Create a dashboard of the best yield-farming opportunities for Terra assets on Ethereum. Please note you will have to use the Flipside ETH tables (documentation provided here: https://app.gitbook.com/@flipside-crypto/s/flipside-docs/our-data/tables/table-schemas)

See all Terra Bounties 🌎

Bounty: Up to 143.03 LUNA

Description: Answer one of these top analytics questions from the community and receive up to 143.03 LUNA as a reward.

Uniswap 🦄

[EASY] Voting Power Distribution 🗳️

Bounty: Up to 14.18 UNI

Description: To vote on governance in Uniswap, you can choose to self delegate or delegate to a trusted party to vote on proposals for the protocol. In the past 30 days, what is the distribution of addresses to votes? How many smaller volume addresses are voting vs. larger volume addresses? Please include your definition of larger vs. small.

[HARD] ETH Price Drop and Liquidity Pools 📉

Bounty: Up to 27.83 UNI

Description: With ETH dropping below $2000 how is it affecting the liquidity pools for ETH? Are people decreasing liquidity of their v3 pools and re-entering it in a new range or are they staying put? With the people who are decreasing liquidity and not coming back in are they holding the amount they took out of their positions or are they moving it to another DEX pool (Sushi, Uni v2)?

See all Uniswap Bounties 🦄

Bounty: Up to 27.83 UNI

Description: Answer one of these top analytics questions from the community and receive up to 27.83 UNI as a reward.

🟥 Agoric

Port Chainlink Price Feed Contracts To Agoric ⛓️

Bounty: Up to $6,400

Description: This issue is to port the core Chainlink aggregation contract functions into Agoric: FluxAggregator.sol; AccessControlAggregator.sol. Implementation must be written in JavaScript following Agoric's smart contract model. The contract must result in a PriceAuthority API that the Agoric Treasury can consume. The Agoric team will review the initial design and will be available for consultation on implementation questions.

Implement AMM Curve For Like-Asset Pairs In Agoric ⤵️

Bounty: Up to $9,600

Description: Implement a curve for Agoric's Automated Market Maker (AMM) which minimizes slippage, similar to curve.fi's StableSwap in Ethereum. A completed bounty will include: A new version of bondingCurves.js using new curve structure; An update to Agoric's MultiPool Autoswap contract to include a term that chooses which bonding curve to use

Build A Pool-Based Loan Protocol On Agoric 🏊♂️

Bounty: Up to $6,400

Description: Launch a basic pool-based loan protocol on Agoric. Functionality should align with pooled loan protocols on other chains (e.g., Compound, Aave, Cream, etc).

🕸️ Bluzelle

Blockchain Inbox 📥

Bounty: Up to 5,500 USDC

Description: An inbox that is keyed on blockchain addresses. Imagine that you need to contact Bob on blockchain X with address Y. How would you do that? You cannot. This is a client application that is the decentralized inbox for all blockchain addresses. It would be a responsive (ie: mobile friendly) app that listens for messages sent to any of your registered addresses. So you can receive messages to your BTC, ETH, DOT, ATOM, BLZ, etc addresses.

Polkadot Pallet 🟣

Bounty: Up to 8,00 USDC

Description: We need to build a “pallet”, using Polkadot Substrate technology. This pallet is like a module, and would get included into a “Parachain”. A parachain is a blockchain that is part of the Polkadot ecosystem. Parachains use a blockchain-building framework called Substrate. Substrate is written in Rust. Pallets are also written in Rust. As such, for testing, you’d likely build your own mini “test” blockchain with Substrate, and test it with your pallet. The pallet would be built and tested to work with any parachain. This test blockchain would be the place to test that the pallet works properly when dropped into any arbitrary parachain.

EVM OCW (Off Chain Worker) Bridge To Bluzelle 🌉

Bounty: Up to $7,500

Description: A challenge right now for smart contract developers on an EVM (Ethereum, BSC, etc), is their inability to get simplified access to Bluzelle's plethora of services (specifically DB and Oracles). Bluzelle offers an oracle and a key value store. It would be valuable for a smart contract to query Bluzelle's oracle for the value of something like the price of the BTC/USD pair, or to ask for the value of a key in the Bluzelle key-value store DB, such as the "name" field in the "ABC" database, where name is, say, "Alice". For the sake of simplicity, we assume only reads happen -- the EVM cannot write to Bluzelle in any way.

🎶 Harmony

Harmony <> ICON BTP Bridge 🎼

Bounty: Up to $7,500

Description: This bounty will add Harmony blockchain to the set of blockchains supported by ICON's BTP interoperability solution. BTP is a decentralized cross-chain data transfer protocol that allows cross-network smart contract interactions, cross-network token transfer, cross-network NFT transfer, and more.

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

Last week, we encouraged you to learn SQL while earning crypto with some easy bounties. We received a ton of great submissions, so thanks to all that participated!

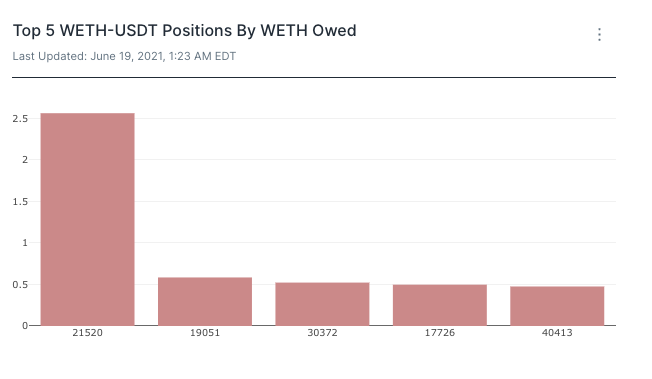

For this week’s Bounty Submission of the Week, we’re highlighting some great work from @danmdoherty. Dan took a look at the max WETH owed to a given position in the WETH-USDT pool.

Dan’s submission found that, as of June 18, 2021, there is one position in the main WETH-USDT pool that’s owed more WETH than any other. According to the findings, NFT ID21520, at more than 2.5 WETH, is owed more than the next four positions combined, as can be seen below.

@danmdoherty also provided a great step-by-step tutorial for completing SQL queries in submission. Check it out here!

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: