Hey there analytics experts,

The waiting — or should we say yearning — is over. Yearn bounties have arrived at Flipside Crypto. Check out our scavenger hunt here to get started.

We’ve got some brand new Yearn bounties below, along with more Terra and Uniswap bounties, plus the best from around the web. Need help solving them? Join our community to get all your questions answered.

🌀 Yearn

Free Square Question 🔲

Bounty: Up to 1,000 USDC

Description: Provide any interesting insights on Yearn. The top 5 dashboards will earn 1,000 USDC. These will be judged by a council that includes other community members and the Flipside team!

Comparing Yearn Vault Strategies 🏦

Bounty: Up to 750 USDC

Description: Select two of the available strategies; define and visualize the returns each has generated over the past 30 and 90 days; and compare their performance. Provide at least one paragraph to explain why one performed better than the other.

Returns on the ‘Generic Leverage Compound Farm’ strategy 🚜

Bounty: Up to 750 USDC

Description: The USDC yVault has a ‘Generic Leverage Compound Farm’ strategy that earns a return by supplying liquidity to Compound, using flash loans for additional leverage. What return in Comp has it earned over the past 30 days and how much in flash loans has it used to earn this?

View all Yearn Bounties🌀

Bounty: Up to 1,000 USDC

Description: Answer one of these top analytics questions from the community and receive up to 1,000 USDC as a reward.

Terra 🌎

[Easy] LUNA Price Volatility 📊

Bounty: Up to 38.25 LUNA

Description: What has the daily volatility (standard deviation of price day over day) of LUNA price been over the past 2 weeks? How does that compare to the volatility of ETH over the past 2 weeks? What are events and/or factors potentially impacting these?

[Easy] Anchor Deposits 💰

Bounty: Up to 38.25 LUNA

Description: How have deposits on Anchor changed in the past 2 weeks? Why do you think this is?

[Easy] Anchor Collateral Ratio ⚓

Bounty: Up to 38.25 LUNA

Description: What has happened to Anchor's collateralization ratio over the past two weeks? What impact has this had on user behavior on Anchor? Pick at least 2 metrics to quantify the impact. (ie. TVL, 24hr volume)

[Hard] UST Collateralization 🪙

Bounty: Up to 76.50 LUNA

Description: To what degree has UST been fully collateralized over the past two weeks? Has it been under collateralized at any points? How long did it stay like that on average?

[Hard] Mirror & Anchor TVL 📈

Bounty: Up to 76.50 LUNA

Description: How have the TVLs on Mirror and Anchor changed over the past two weeks? Are there any correlations that you can see? What might be some reasons for these relationships?

View all Terra Bounties 🌎

Bounty: Up to 76.50 LUNA

Description: Answer one of these top analytics questions from the community and receive up to 76.50 LUNA as a reward.

🦄 Uniswap

[New Users Only] LP Fees 💧

Bounty: Up to 12.10 UNI

Description: Summarize the fees collected by LPs over time. Do we notice any trends? Tip: Use uniswapv3.position_collected_fees

[New Users Only] Swap Volume Comparison 🔀

Bounty: Up to 12.10 UNI

Description: Compare the swap volume for V2 vs V3 over time. How has that changed? Tip: Use ethereum.dex_swaps

[Easy] Uniswap Weekly Volume Breakdown 📅

Bounty: Up to 12.10 UNI

Description: For the past 10 weeks, what has been the week over week change in total volume for Uniswap in total? What has been the week over week change in total volume for each of the top 5 pools by volume (ranking determined by most recent week?)

[Super Hard] Impermanent Loss Dashboard 📊

Bounty: Up to 36.55 UNI

Description: Calculate the IL vs HODL of the top 10 most active LPs on the top 10 pools.

View all Uniswap Bounties 🦄

Bounty: Up to 36.55 UNI

Description: Answer one of these top analytics questions from the community and receive up to 27.83 UNI as a reward.

🟥 Agoric

Smart Liquidation Module For Agoric Treasury 🧠

Bounty: Up to 9595.20 USD

Description: This bounty asks you to provide a new liquidation strategy for loans of RUN provided by the Agoric Treasury. The context section below gives background detail on the current approach and our goals.

Build a liquidation contract that can be used by the Agoric Treasury’s vault manager contract instead of the current liquidation contract (see References section).

This strategy should use market data available to it to manage liquidations. It is the job of the bounty applicant to propose a coherent liquidation strategy

🪙 Gitcoin ETHCC Hackathon 2021

Personality Tokenization for ERC 725 🧍

Bounty: 5976.30 USD

Description: Thank you for your interest in building projects for the ETHCC hackathon 2021 in Paris. The Curio Team invites you to participate in the development of a personality tokenization system on Ethereum using the ERC 725 standard. Personal tokenization implies a Reputation Token associated with a specific user's wallet in any decentralized application, for example, on an exchange or marketplace. This will allow you to carry out secure transactions on the marketplace and increase trust among users of the platform using this mechanism.

🦡 Badger Finance

Revamp Sett.Vision Into The Portfolio View 💰

Bounty: 680.59 BADGER

Description: BadgerDAO is a fair-launched DeFi DAO, that provides asset management services focused on bitcoin, and with a mission to extend the use of Bitcoin in DeFi. Our core product is a group of vaults, or as we call them, Setts(the name of a badger home). Long ago we had a dashboard called sett.vision which provided users detailed information about our vaults, and their holdings and earnings. It is no longer functional as we have not kept up with adapting it to protocol changes, but you can see it here: https://sett.vision. Over the last month, we have come up with a concept to rebuild this and integrate it into a new portfolio function in our main dapp.. We have already worked with a UX designer to come up with a Figma, now we just need it built.

🤵 iExec

Chest X-Ray Covid Classifier Using Blockchain & IExec Confidential Computing 🩺

Bounty: 1524.00 RLC

Description: Application for analyzing chest X-ray images to classify whether the lungs are healthy, with pneumonia or COVID. The classification is achieved using a trained neural network algorithm. The application uses confidential computing on the images (confidential patient data) so that only the requester of the computation (the doctor) will be able to see the results, even if the computation is made on a distributed network.

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

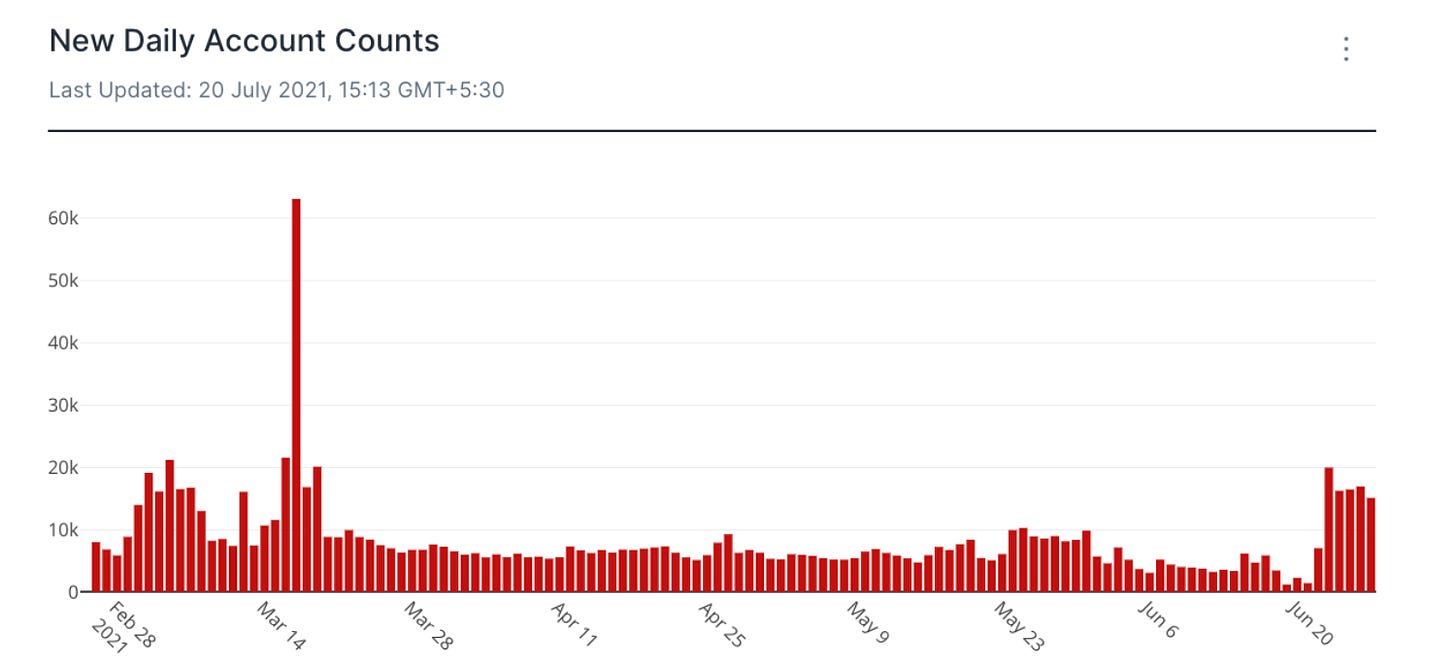

In this week’s edition, we’re giving our Terra bounties some love in the form of a submission from @shreyashpatodia, who examined the number of new addresses joining Terra each day.

As we can see below, the number of new users has spiked in recent weeks, with more than 10,000 new users on each of the last few days in June. This is an increase over the 5,000 to 8,000 accounts that typically join each day. It’s also the most since an even more significant peak during LUNA’s ATH and the launch of Anchor.

@shreyashpatodia had more insights to offer, so be sure to check out the submission here.

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: