Hey there analytics experts,

Want new ways to earn crypto? We’ve got you covered. In case you missed it, Flipside is now offering content bounties for great writing, infographics, and more. Learn more below.

We’ve also got some brand new analytics bounties from Flipside Crypto below, plus the best from around the web. Need help solving them? Join our community to get all your questions answered.

Terra 🌎

[Easy] Active Addresses 📬

Bounty: Up to 17 LUNA

Description: Of all addresses that delegated in Q1 2021, how many active on June 30th?

[Easy] New Mirror Assets 🪞

Bounty: Up to 17 LUNA

Description: Pick two times from Jan-Jul 2021 when a new asset was introduced on Mirror - was there an increase or a decrease in volume or TVL for other existing Mirror assets when this happened? What does this say about how elastic capital on Mirror is to different asset offerings?

[Easy] Terra Fees & Transaction Volume Correlation 💸

Bounty: Up to 17 LUNA

Description: How have fees changed over time on Terra? Is this correlated with total transaction volume on Terra?

[Easy] Luna Delegation Distribution 🗳️

Bounty: Up to 17 LUNA

Description: Plot the amount delegated to the top 10 validators. Calculate the percentage of validators that hold 95% of the delegated LUNA. Would you say that LUNA delegations are concentrated or well distributed?

[Hard] Mirror Volume & TVL 💰

Bounty: Up to 34 LUNA

Description: On July 23rd, Uniswap announced that it would be blacklisting all mAssets. Over the past two weeks what has the TVL and volume been on Mirror? Did these two metrics show a marked change when or around when the announcement came out?

[Elite] Anchor Historical APR ⚓

Bounty: Up to 68 LUNA

Description: What has Anchor's historical APR by day and by week been since launch? Hint: Find the borrow rate by block (refer to Anchor docs on how to calculate this) and aggregate it. You get 2 weeks for elite bounties - the reward is also twice that of a hard question as a result.

View all Terra Bounties 🌎

Bounty: Up to 76.50 LUNA

Description: Answer one of these top analytics questions from the community and receive up to 76.50 LUNA as a reward.

🦄 Uniswap

[Easy] Weekly TVL Breakdown 📊

Bounty: Up to 9.59 UNI

Description: For the past 10 weeks, what has been the week over week change in TVL for Uniswap in total? Show this for the top 5 pools by volume (ranking determined by most recent week?)

[Hard] Pool Positions Dashboard 💧

Bounty: Up to 19.55 UNI

Description: Is there a way to see all active positions from all LPs for a given Uniswap V3 pool? What are 3 ways to visualize this effectively?

View all Uniswap Bounties 🦄

Bounty: Up to 19.55 UNI

Description: Answer one of these top analytics questions from the community and receive up to 19.55 UNI as a reward.

🌀 Yearn

Free Square Question 🔲

Bounty: Up to 1,000 USDC

Description: Provide any interesting insights on Yearn. The top 5 dashboards will earn 1,000 USDC. These will be judged by a council that includes other community members and the Flipside team!

Comparing Yearn Vault Strategies 🏦

Bounty: Up to 750 USDC

Description: Select two of the available strategies; define and visualize the returns each has generated over the past 30 and 90 days; and compare their performance. Provide at least one paragraph to explain why one performed better than the other.

Returns on the ‘Generic Leverage Compound Farm’ strategy 🚜

Bounty: Up to 750 USDC

Description: The USDC yVault has a ‘Generic Leverage Compound Farm’ strategy that earns a return by supplying liquidity to Compound, using flash loans for additional leverage. What return in Comp has it earned over the past 30 days and how much in flash loans has it used to earn this?

View all Yearn Bounties🌀

Bounty: Up to 1,000 USDC

Description: Answer one of these top analytics questions from the community and receive up to 1,000 USDC as a reward.

☊ Nervos

Create A Godwoken Account On The EVM Layer 2 Testnet 2️

Bounty: Up to 1000.00 CKB

Description: Nervos supports the use of Ethereum compatible smart contracts which allow developers to create dApps using the popular Solidity smart contract language. This is done by running the EVM (Ethereum Virtual Machine) in a Layer 2 based execution environment using the Godwoken and Polyjuice frameworks. EVM dApps run nearly identically on Nervos as they do on Ethereum. This, in turn, allows dApp users to continue using the popular MetaMask wallet without having to install anything new. DApp users who are familiar with Ethereum will feel right at home!

Port An Existing Ethereum DApp To Polyjuice 🚢

Bounty: 7500.00 CKB

Description: In this tutorial you will learn how to port an existing browser Ethereum application to run on Nervos' EVM compatible Layer 2. The eventual goal of Polyjuice is 100% compatibility with existing EVM smart contracts. However, this goal is still being worked on, and there will always be a few differences in the setup of the development environment and the tooling and frameworks that are used.

View all Nervos Bounties ☊

Bounty: 7500.00 CKB

Description: Answer one of these analytics questions receive up to 7500.00 CKB as a reward.

Wallfair 💸

Connect To Ethereum Wallet & Associate User Account To Ethereum Address 👛

Bounty: 700.00 USD

Description: This is a PoC task in which we want to enable Ethereum wallet ie. Metamask in context of Wallfair client, obtain Ethereum address from injected Web3Provider and associate it with user data stored in https://github.com/wallfair-organization/backend. You should use web3-react to handle connection process. In this task we ignore the need to validate address ownership via signing a challenge message. This task also requires calling an API method on backend as specified later.

YieldHand ✋

Create Basic Iteration Of SubGraph For YieldHand Options Market Contract 📝

Bounty: .04 ETH

Description: YieldHand is building an options marketplace protocol that has OTC sell orders and allows prospective buyers to search the listed orders/offers and purchase options directly from sellers which they can later exercise based on a filtering system on the UI. The dApp that interfaces with this contract will use The Graph (consuming data from the web app UI via an API) to query for ACTIVE/non-expired option sell orders.

🏆Bounty Submission of the Week 🏆

Welcome back to our Bounty Submission of the Week!

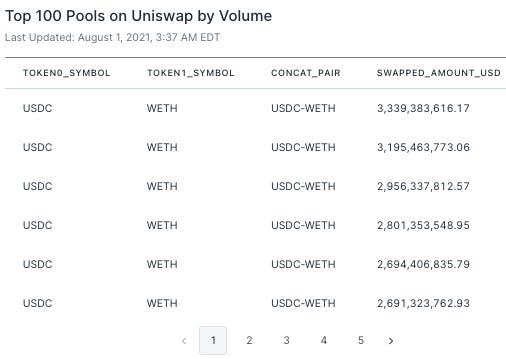

In this week’s edition, we’re giving our Uniswap bounties some love in the form of a dashboard from MarneeSeaweed. This submission focuses on Uniswap pools — specifically the differences between the top pools on Uniswap V2 and those on V3.

As MarneeSeaweed notes in this submission, the top pools in V2 often included stablecoins and wrapped Ethereum, namely USDC-WETH and USDT-WETH. And, as we can see in the table below, meme coin pairs like SHIBA and STARL weren’t too far behind.

On V3, meanwhile, stablecoin pairings have doubled down on their dominance. The top five pairs on V3 feature stablecoins paired with wrapped Ethereum, or paired stablecoins.

MarneeSeaweed had more insights to offer, so be sure to check out the submission here.

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: