Hello there, Bounty Hunters 👯

Are you a part of our community on Discord? If not, you should be.

Onto this week’s bounties, including some from Uniswap, Compound, and more.

Uniswap 🦄

[Easy] Active Liquidity 💧

Bounty: Up to 9.47 UNI

Description: Find the 5 largest liquidity pools in Uniswap V3. What percentage of positions and what percentage of virtual liquidity (liquidity_adjusted) are currently out of range? When this occurs which is the approach most taken: updating the range or waiting it out.

[Hard] Concentrated Liquidity 💦

Bounty: Up to 9.47 UNI

Description: In terms of concentrating liquidity in specific ranges. Look at the top five liquidity pools. What are the reward rates associated with concentrating liquidity in larger ranges that have more providers? What are the reward rates associated with concentrating liquidity in smaller ranges in areas where there are not as many providers? Compare these rates and visualize this comparison.

[Hard] Capital efficiency ⛑

Bounty: Up to 9.47 UNI

Description: Find the 5 largest liquidity pools in Uniswap V3. How does the capital efficiency (efficiency of capital increased is by getting more out of the same amount of money) compare to the same pools in V2? What range incorporates at least 75% of the liquidity in the pool?

See all Uniswap Bounties🦄

Bounty: Up to 9.47 UNI

Description: Answer one of these top analytics questions from the community and receive up to 9.47 UNI as a reward.

📈 Compound

[Easy] How does price volatility affect the borrow APY? 📈

Bounty: Up to 0.5 COMP

Description: Show how sharp price changes have affected the borrow APY in the past. To answer this question, please include a clean definition of volatility and specific tokens for comparison.

[HARD] What are the risks associated with pool liquidity falling too low? 📉

Bounty: Up to 0.5 COMP

Description: What are the risks associated with pool liquidity falling too low? How often has this occurred in the past 6 months? When is this most likely to occur?

[HARD] What happened to leveraged borrows with the crashes a few weeks ago? 💥

Bounty: Up to 0.5 COMP 📊

Description: Show how sharp price changes have affected the borrow APY in the past. To answer this question, please include a clean definition of volatility and specific tokens for comparison.

See all Compound Bounties💰

Bounty: Up to 0.5 COMP

Description: Answer one of these top analytics questions from the community and receive up to 0.5 COMP as a reward.

🌐 Turq

Enable Users to Post 📌

Bounty: 80.04 USD

Description: Viewable Figma here with frontend. Need the intake to have the following 5 steps: Issue Headline Issue Description/details Legislation Needed Location of Concern Funding or Sharing on Twitter.

🎶 Harmony

Expose All Configuration Variables And Values 🔍

Bounty: 4883.14 ONE

Description: We need to expose all configuration variables and values to the log file and RPC interface. An option/flag in the configuration to print all configuration variables and their values in the log file, as a way to debug the configuration changes. Also, a new RPC interface to expose all configuration variables and values.

PPF Module Extension ↔️

Bounty: 29298.84 ONE

Description: Extend the harmony node's Pprof service with some advanced developer options.

🦸 Sovrython

Data-Science-Advanced-Analytics-And-Simulations 🧮

Bounty: $7,500 in SOV

Description: We are having loads of data and not enough people to read it! We are in need of advanced analytics on our trading data, simulations of the effect of smart contract settings (e.g. parametrization of the EMA for the v1 pool oracles), and ways to observe the effect of our marketing campaigns.

Data-Science-Oracles 🔮

Bounty: $7,500 in SOV

Description: Almost every action on Sovryn requires a price oracle. While we are transitioning our core protocol to using only internal oracles maintained by our AMM converters, we still have a need for external price feeds (or other data oracles) for new features and products. You can submit your solutions to both our Covalent and API3 partner bounties and this one.

Data-Science-API 🧪

Bounty: $7,500 in SOV

Description: The easier it is for third parties to connect to Sovryn, the better. Currently, the only API is the smart contract ABI. It would be great to see an easy-to-use API for querying our contract data. You can submit your solutions to both our Covalent and API3 partner bounties and this one.

🏆Bounty Submission of the Week 🏆

Submitted by CrypGOAT on Discord

Welcome back to our Bounty Submission of the Week!

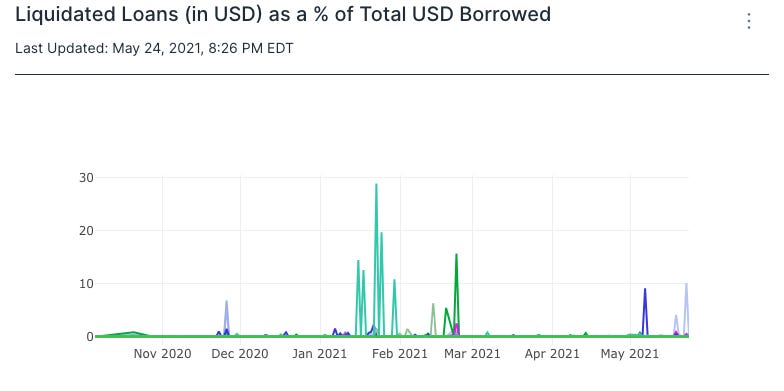

According to CrypGOAT on Discord, there have been several major liquidation events in recent history on the Compound platform.

First was the liquidation of 6.8% DAI, among other liquidations, in November of last year, caused by DAI coming off its peg and reaching highs of as much as $1.30. That was followed by several UNI liquidations in the early part of this year, including 15% of WBTC borrowed was liquidated on February 22, coinciding with a big slide in Bitcoin prices. As we can see in the chart below, the more recent waves of liquidations have likely been triggered by broader bear markets as well.

But, as CrypGOAT points out, it’s important to remember that the scales of borrowing markets can be vastly different. And, as a result, large percentage liquidations in small markets can lead to lower absolute value, as seen below.

CrypGOAT had tons of great findings we couldn’t fit into this newsletter, so make sure you check out their submission to see all of the dynamic data they presented, and get your submissions in to be considered for future editions of the Bounty Brief.

🌟 ICYMI 🌟

Eric Stone, our Head of Data Science, was a guest on the most recent On the Brink podcast from Castle Island Ventures! Eric was joined by Matteo Leibowitz of Uniswap to talk about Uniswap V3, our labeled, on-chain data and how it’s being used on V3, and much more.

If you want more Uniswap V3 insights, check out our Uniswap V3 Fee Calculator. It’s totally not investment advice 😉

Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries:

Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: